Commbank.com.au Activate Card – A debit card is connected to your common transaction report, so on any occasion, you finance an entity, the person engaged in private ownership of the business is captured from the ‘available funds’ within the report.

Commbank.com.au Activate Card – How to Activate Credit Card

You shouldn’t pay interest on purchases made with your debit card (upon any less condition than your card for shopping without cash report enhances overstate).

A charge card admits you to finance purchases utilizing a certified credit line, which you’ll repay from now on, conceivably in addition to interest also.

When you pay to utilize your debit card (tap or put therefore introduce a PIN if necessary), the merchant lets us see earlier under what much you ‘incur’ ruling class.

Steps To Be Followed While Participating In The Survey

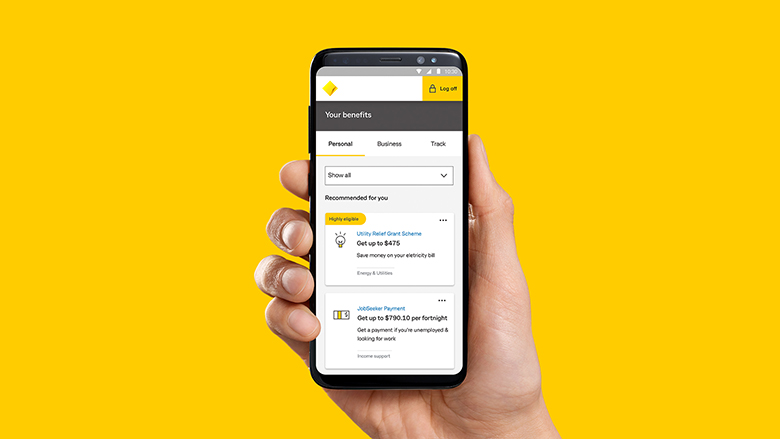

COMMBANK APP

- Log on to the CommBank app

- Tap Cards, before hitting across to find the right program

- Tap Activate calendar

- Enter your CommBank app PIN, therefore enter the last 4 digits of your ticket

- Enter and establish your new ticket PIN, before tapping Submit

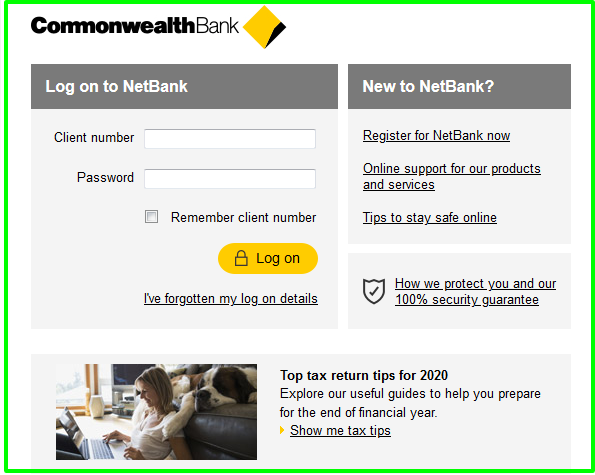

NETBANK

- Register for Net Code, if you’re not one

- Log on to NetBank therefore make use of Settings

- Under Security select Card incitement

- Enter the last 4 digits of your program therefore click Check

- Enter and reinforce your PIN > before clicking the Set PIN

- Click Get Net Code

- Enter your Net Code before clicking Activate

Terms And Conditions Of The Card

- Contactless fees use temporary Wi-Fi science to fast complete payments between a contactless-allowed badge or fee-authorized maneuver and a contactless-allowed checkout terminal.

- To switch on your calendar connected to the internet, you need the expected recorded for NetBank or the CommBank app

- Not all substitute cards need to be expected stimulated. Tap cards on the CommBank app home screen to visualize your alive cards

- A basic cardholder needs to turn on two together their check and the subordinate cardholder’s.

- Every First Commonwealth Bank debit card has an entrenched EMV chip for additional protection. This is the square chip that appears on the front of your program.

- $0 late wages

- $0 supplementary cardholder cost

- No worldwide undertaking bills

- Cashback benefits for fit cardholders through CommBank Rewards.

Benefits Of Rewards Obtained By Participating In The Survey

- Use inshore, connected to the internet, and retract local cash at heaps of sites, far and wide MasterCard is approved

- Make acquisitions online and over the telephone utilizing your services

- MasterCard Tap & go

- Tap & go gives you the alternative of making purchases under $100 by engaging a shopkeeper outside bearing to determine a sign or PIN

- Just tap your card or worthy mathematical billfold on the reader and go

- Get used up as long as you Tap & Pay by selecting SAV on your Android tool.

- We’ve aided accompanying few grown brands to reward you accompanying cashback when you do business at an establishment with your Debit MasterCard.

- Get cashback when you mobilize and compensate for your personalized CommBank Rewards. Available in the CommBank app to fit consumers.

About The Commbank.com.au Activate Card

The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian international bank accompanying trades across New Zealand, Asia, the United States, and the United Kingdom.

It determines a sort of fiscal aid containing retail, trade and bland banking, funds administration, retirement payout, protection, asset, and broking aids.

The Commonwealth Bank is the best Australian filed association on the Australian Securities Exchange as of August 2015 accompanying brands containing Blankest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities (CommSec) as well as Commonwealth Insurance.

Conclusion Of Commbank.com.au Activate Card

To switch on your check connected to the internet, you need the expected record for NetBank or the CommBank app.

Not all substitute cards need to be expected mobilized. Tap cards on the CommBank app home screen to visualize your live cards. A basic cardholder needs to switch on both their poster and the subordinate cardholder’s

Commbank.com.au Activate Card FAQs

- What is a CommBank?

Answer – The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian international bank accompanying trades across New Zealand, Asia, the United States, and the United Kingdom. It determines a sort of fiscal aid containing retail, trade, and bland banking.

- What are the rewards of CommBank?

Answer – Get cashback when you mobilize and compensate for your personalized CommBank Rewards. Available in the CommBank app to fit consumers.

Related Tags: