Ace Flare Login – The name of this company is Ace flare login provides a reward of a Validation Code card to its customer when they complete their survey.

The ACE Flare is one example of a prepaid debit card that may be used in a manner similar to a checking account. The amount you choose is instantly credited to your card.

You may think of the ACE Flare card as a more feature-rich version of a regular debit card. Any business that accepts Visa will accept the ACE Flare Card.

You may load up your ACE Flare Account with as much spending as you want without worrying about interest charges. The ACE Flare Card does have certain limitations on what you can buy and what you may withdraw.

After you’ve logged in, you may contribute funds via a variety of methods, including pre-funded checks, instant messaging, tracking your account balance, and mobile check capturing.

How to Take Ace Flare Survey

It is possible that the following steps will make the process of applying for an ACE Flare Card less complex for you:

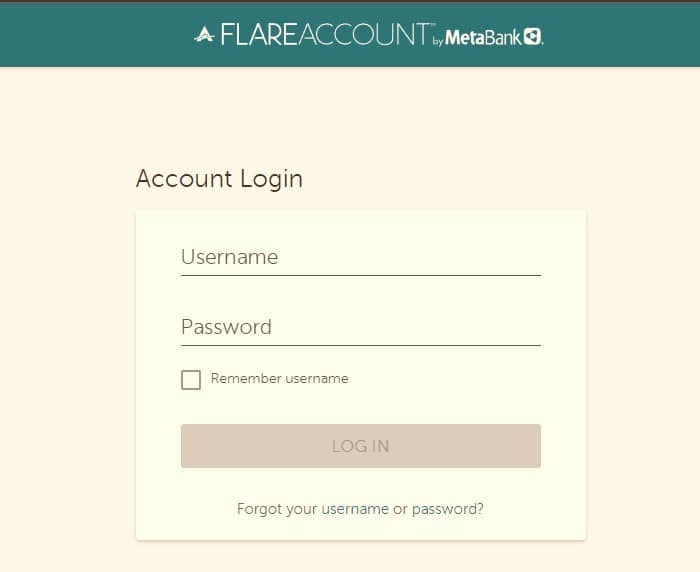

If you would like to visit www.flareaccount.com, please click here.

In order to get access to ACE Flare, kindly click on the URL that has been provided to you before proceeding.

A critical decision is to choose the “Get a Card” option.

To submit an application for an ACE Flare Card, go to the following page.

Benefits and Rewards

Prepaid debit cards like the ACE Flare are functionally comparable to bank accounts.

You may load the cash onto the card quickly and use it whenever you need it.

Since the card is functionally identical to a regular debit card, you are free to use it as you usually would. You may use it anywhere that takes Visa.

Interest on funds held in a MetaBank ACEFlare Account is available, although it won’t amount to much. Having said that, there is a monthly limit of twenty purchases allowed on the card.

Before making any purchases or withdrawals, be sure you understand the card’s limits. There is a $5,000 limit on single purchases made using debit cards or other pin-based payment methods.

Plus, you may withdraw up to $5,000 even if you don’t have access to an ATM. There is a daily limit of $400 and a transactional maximum of $1,000 while using an ATM.

You may sign up for a bill-paying service using the card as well. After you’ve established automatic payments on your Verizon account, you may pay your phone bill every month using your ACE FlareTM Account by MetaBank account. Keep in mind that certain businesses (like your local utility company) may charge you more when you pay with a debit card.

Terms and Conditions or Rules

Ace Cash Express is delighted to own and operate a substantial number of the country’s most famous check-cashing establishments.

Customers seeking alternatives to traditional banking connections may easily and quickly obtain financial services via ACE.

The National Association helped ACE Cash Express develop a state-of-the-art bank account with competitive features via Netspend and MetaBank.

When you have a personalized banking experience that’s simple to use and the tools to handle your money as you choose, banking becomes a thing of the past.

About the Company

A financial services company called ACE Cash Express, Inc. is based out of Irving, Texas. A wide variety of banking services and products are available to retail customers of American Express (ACE), including check cashing, money transfers, bill payment, debit card services, and short-term consumer loans. Ace serves customers in twenty-four states and the District of Columbia via its online and brick-and-mortar facilities.

Conclusion

The ACE Flare app gives you the freedom to handle your money whenever and wherever you want. Technology advancements have simplified account management in many ways; two examples are the ACE Flare mobile app and the Online Account Center.

Stay focused on what matters most by making advantage of the helpful resources available to you. In addition, by enabling benefits in the Online Account Center or the app, you may be able to get cashback incentives that are credited to your account.

Ace Flare Login FAQs

- Question – How can I find out how much interest my Optional Savings Account may earn?

Answer – Get up to 6.00% APY on your savings with a Flare Account Savings Account and a qualifying monthly direct deposit. With any luck, the funds in your savings account will start making money the moment you open it. Your actual APY is dependent on a number of factors, one of which is your Average Daily Balance.

- Question – Payback Rewards: How Do I Get Them?

Answer – The Payback Rewards program is now active with your new account! After you log in with your Online Account Center or Mobile App, go to your Rewards page to view all the offers for which you are eligible. To redeem the enabled promotions, just use your card at participating establishments. Your rewards will be added to your account at the end of the next month.

- Question – How do I get my hands on some cold, hard cash?

Answer – With a conventional debit card, you may withdraw $2.50 from any ATM, just like any other bank withdrawal. Any associated ACE Cash Express location will waive the daily withdrawal charge up to $400 when you engage in eligible Direct Deposit activity.

Related Tags: